Make financial crime visible, with data you can't see

Roseman Lab's game-changing technology makes cross-organizational data analysis possible - fully compliant, trusted by banks and law enforcement agencies.

Stopping financial crime requires inter-bank data

Efforts to detect and prevent financial crime are resource-heavy, time-intensive or simply ineffective. Crucial data is not shared due to compliance issues and a lack of trust amongst financial institutions - meaning financial crime can thrive in the gaps.

Roseman Labs changes that, making connections visible without exposing sensitive data.

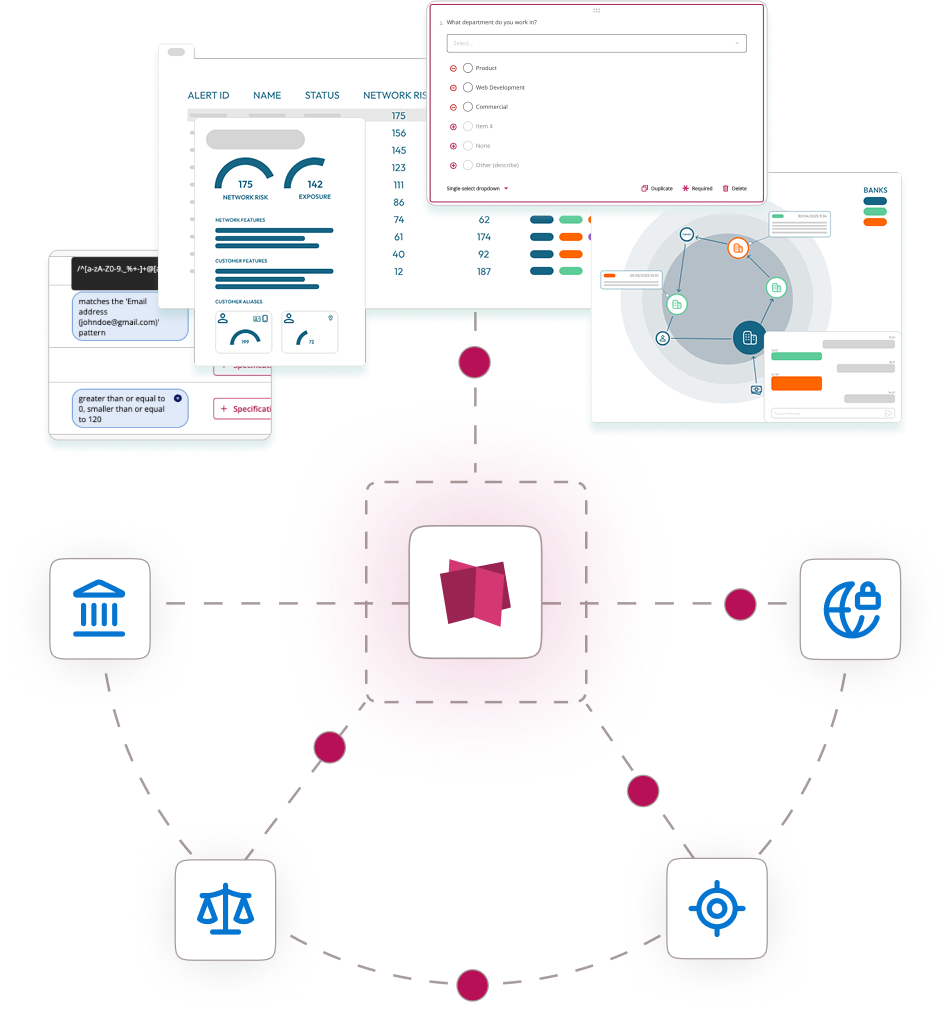

See connections

Build a complete picture

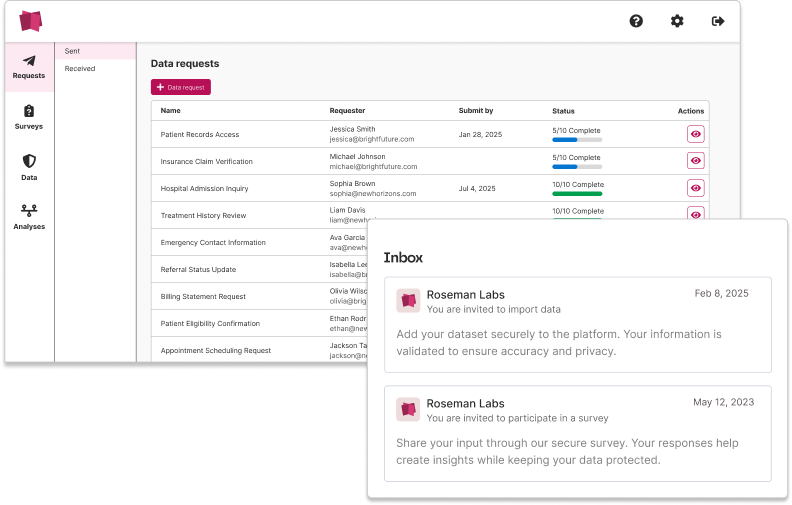

Combine alerted client data and suspicious transactions to create a complete view. Our platform makes signals visible in a financial landscape.

Scale your efforts

Reduce false positives

95% of suspicious banking alerts are false positives, all of which need to be assessed individually. Banks can reduce this with encrypted computing, reducing manual processing and helping investigators better prioritize.

Trusted

Accelerate investigations

With Roseman Labs financial institutions can speed up the detection of suspicious anomalies and patterns, targeting true alerts faster and reducing burden on investigators.

Link data across financial institutions

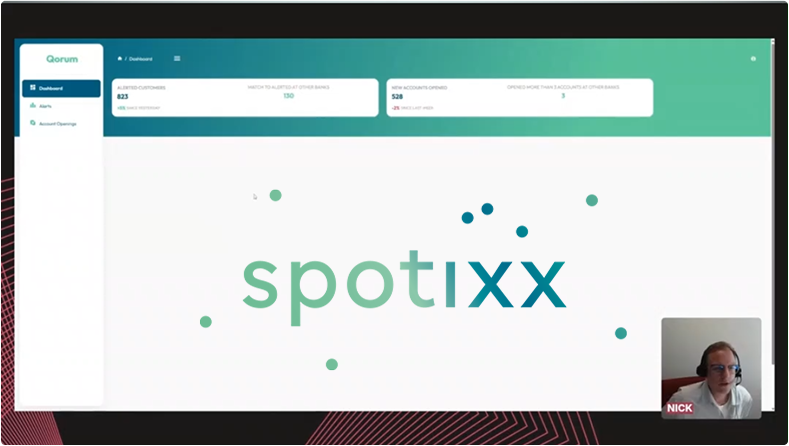

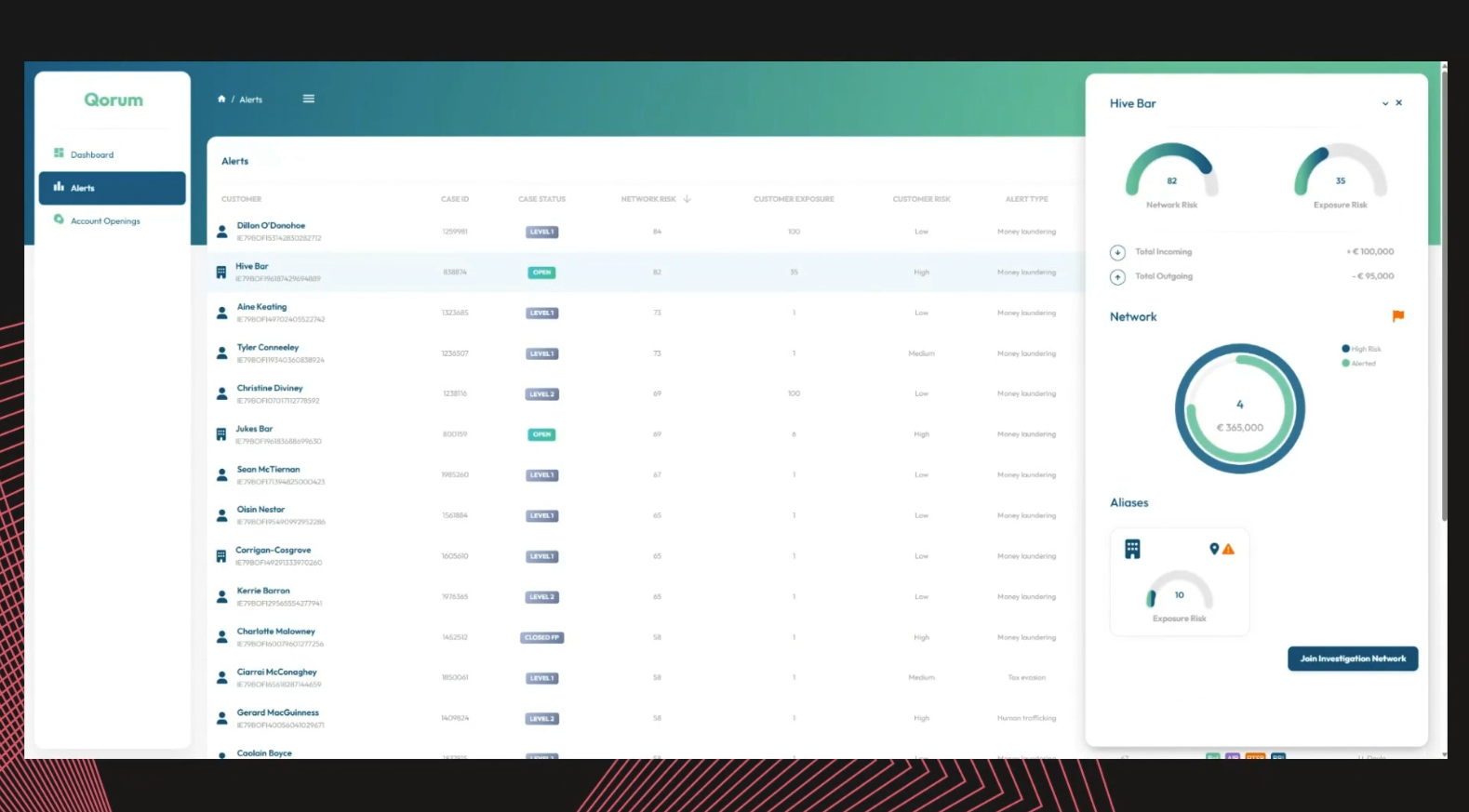

FinCrime intel in action

Watch the demo with our partner spotixx, of the Qorum platform; a simple platform for banks to connect information on FIU cases.

See how Toll Gates can be used to flag suspicious activity, and prioritise investigations.

Join us at an event!

Building the infrastructure

for modern Anti-Financial Crime.

Platform

Improved KYC and AML processes

If an individual opens multiple accounts across different banks, it can be an indicator of future fraudulent behavior. Connecting these signals across banks allows banks to anticipate and prevent money laundering or fraud, by having better KYC information on hand.

You stay in control

Secure insights without tradeoffs

Financial crime thrives in blind spots while banks try to protect customer data. Encrypted computing has proved it can do what regulators, banks, and investigators need to make those gaps visible - by matching suspicious activity across institutions, without ever exposing sensitive data.

With Roseman Labs, financial institutions can analyze detailed client data from banks, without the need to centralize or transfer vast amounts of privacy sensitive information.

AMLR75

New regulation on information sharing

Article 75 of the EU's upcoming Anti-Money Laundering Directive is a game-changer for banks and financial services. The legislation aims to create a unified network for information sharing, making it more simple than ever to work together on fraud and anti-money laundering use cases.

Read more about Roseman Labs' involvement in the Central Bank of Ireland sandbox where we demonstrate how our platform aligns with AMLR75.

Explore your use case

Speak with the team

Toon Segers | Freya de Mink | Ian Wachters | Thomas Berris

Navigating how to work with sensitive data can be complex, but we're here to help. Talk with one of our Directors to learn how you can easily generate new insights on private data by integrating Roseman Labs.

Whether you already know your data collaboration partners, or are exploring a use case, don't wait to get started - get in touch!

Production-ready solutions

Choose your application

- Available as an off-the-shelf solution

- Integrate partner solutions with pre-built application layers

Integrate into your IT stack

Build on the engine

- Integrate into your existing stack

- Deploy on any cloud, or on-premise

- Supports near real-time and batch analysis

- APIs and SDKs available

Book a demo

Enter your details and we'll be in touch to book a free, no-obligation demo with you.

- Analyze vast amounts of data quickly

- Safely use sensitive data with state-of-the-art encryption

- Gain new insights to make well informed decisions

Read more about our commitment to privacy in our Privacy Policy.