Banks play a central role in keeping our financial system robust and clear of criminal activities. It’s estimated that the cost of financial crime auditing and compliance is 200-300 billion USD. This means banks are spending hundreds of millions on staff and IT to track and prevent financial crime and, potentially paying more in fines if they fail to comply.

An important element in the effort to address financial crime, is the assessment of banking alerts. For example, transactions and account behavior that suggest money laundering. Every alert needs to be reviewed, and if it is considered to be sufficiently suspicious, it is reported via a Suspicious Activity Report (SAR) to the national Financial Intelligence Unit (FIU). The constant trade-off banks need to make is between how many triggers the system generates, compared to how much effort can realistically be put into assessing them all.

Joining forces

In a real-life example, three banks (names withheld, and in a non-disclosed country), tested an approach in which they would leverage each other’s data when making a first assessment of alerts. If they could connect an alert from one bank to alerts at another, they could leverage the information from multiple alerts to assess how likely the alert was to be a true positive. Sharing data between banks is a significant challenge, given strict banking and privacy regulation; banks can only access data within their own business (and even this is not always possible), and not those of other banks.

Connecting alerts

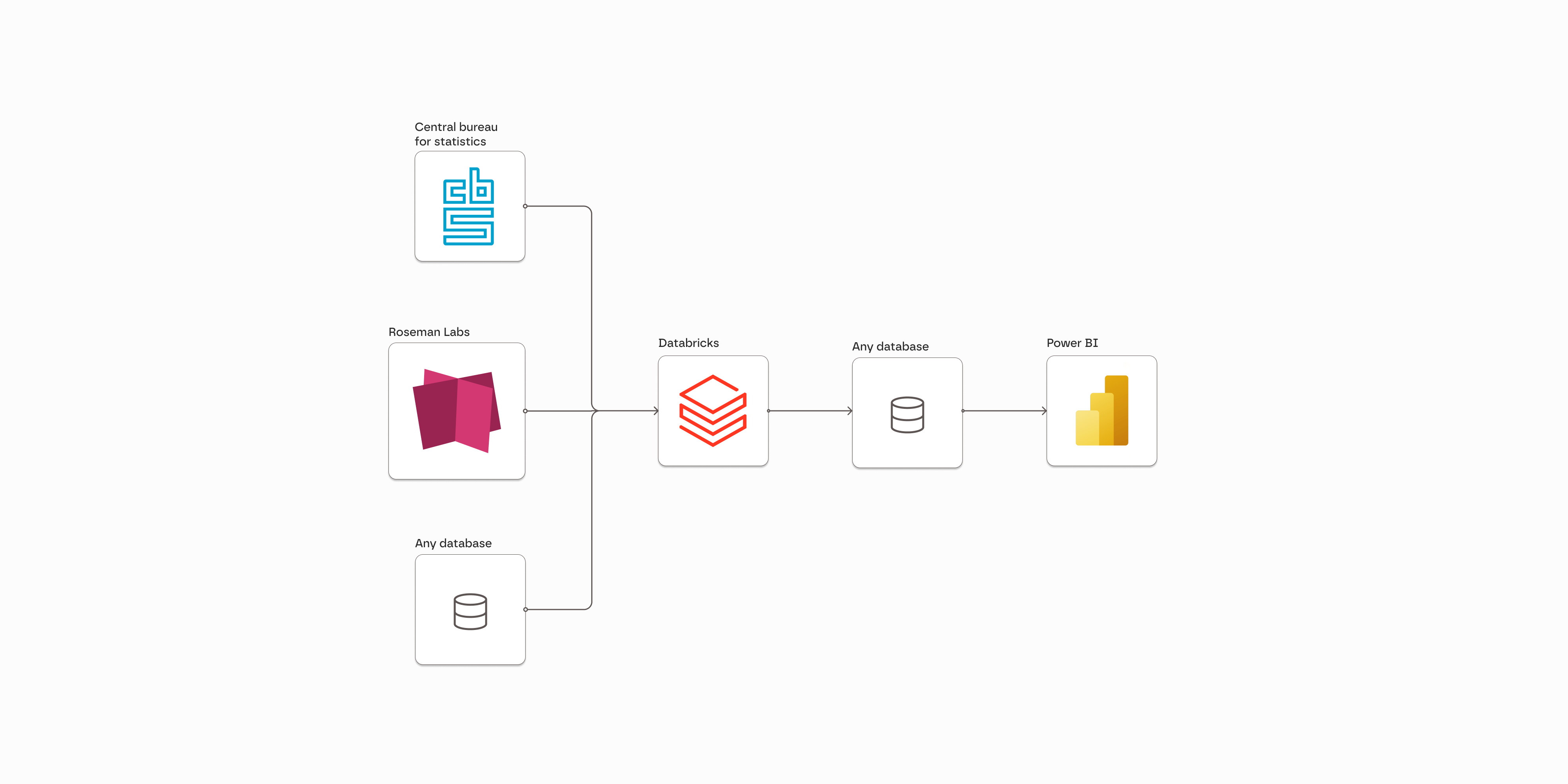

Roseman Labs, however, brings a solution. With our platform, these banks could combine their alert data and based on transaction information, connect alerts to one another. With these connections, they could run a scoring model across the combined information. All these steps, without any privacy or commercially sensitive information being disclosed to each other.

The only information a bank would receive is whether the alert they submitted is connected to alerts at another bank. If they’re connected, a score is generated on the likelihood of the alert being a true or false positive. With this, banks can prioritize alerts much better, saving significant amounts of money on investigation efforts. Banks would also be able to leverage the information from these connected alerts to get guidance on how to best investigate them, making the investigation more effective.

These banks are working on the next steps of implementation, but together with Roseman Labs, they have shown that they can make their alert assessment process much more efficient and effective, while keeping their sensitive client and alert data fully private.

Generate new insights on sensitive data with Roseman Labs’ secure Multi-Party Computation technology. Want to find out how your organization can do that? Contact us using the form below.

Book a demo

Enter your details and we'll be in touch to book a free, no-obligation demo with you.